Shares of Super Micro Computer (NASDAQ: SMCI) were in sell-off mode after the company released fiscal 2024 third-quarter results (for the three months ended March 31) on April 30.

That may seem a tad surprising considering the outstanding growth the company delivered during the quarter. More specifically, Super Micro stock was down more than 11% in pre-market trading on May 1. Investors pushed the panic button as the server manufacturer’s revenue was slightly below expectations.

However, a closer look at the company’s performance will make it clear that Super Micro’s drop is a buying opportunity that savvy investors should consider grabbing with both hands. Let’s look at the reasons why.

Super Micro is growing at a red-hot pace

Super Micro’s fiscal Q3 revenue tripled on a year-over-year basis to $3.85 billion. However, that reading was slightly below the consensus estimate of $3.96 billion. Meanwhile, the company’s non-GAAP earnings increased to $6.65 per share, a quadruple jump over the year-ago period’s figure. What’s more, Super Micro’s earnings were significantly higher than the consensus estimate of $5.74 per share.

Super Micro’s management credited the outstanding growth in the company’s revenue and earnings to the booming demand for the artificial intelligence (AI) servers that it manufactures. CFO David Weigand remarked on the latest earnings conference call:

Q3 growth was again led by AI GPU platforms which represented more than 50% of revenues with AI GPU customers in both the enterprise and cloud service provider markets. We expect strong growth in Q4 as the supply chain continues to improve with new air-cooled and liquid-cooled customer design wins.

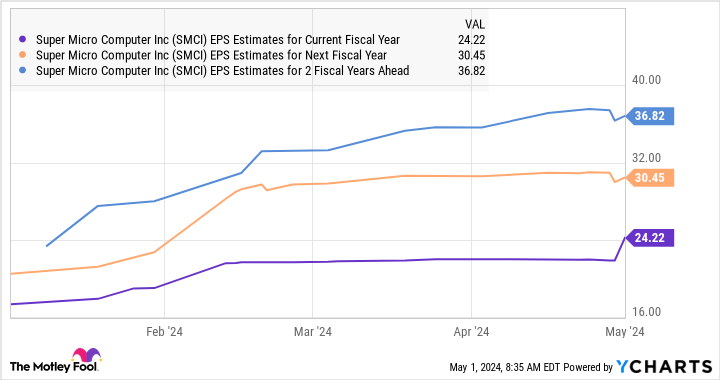

The solid demand for Super Micro’s AI servers explains why the company has raised its full-year revenue forecast once again. It now expects to finish fiscal 2024 with revenue of $14.9 billion at the midpoint of its guidance range, up from the previous estimate of $14.5 billion. It is worth noting that Super Micro was originally anticipating fiscal 2024 revenue of $10 billion when it released its fiscal 2023…

..