Cheap stocks end up cheap for a reason, which is one of the hard truths of value investing. You usually have to be willing to go against the grain and buy out of favor stocks despite the market’s concerns. Right now Rexford Industrial (NYSE: REXR) and Toronto-Dominion Bank (NYSE: TD) are on the outs, but that’s left them both with historically high dividend yields. Now is the time to act. Here’s why.

Rexford is focused on an attractive market

When it comes to warehouses, Southern California is fairly unique. It is the largest industrial market in the United States. It would be the fourth-largest industrial market in the world if you were to break it out from the broader United States, and it is over twice the size of the next-largest U.S. market, New York and New Jersey.

Despite its size, it has a lower vacancy rate than the other major U.S. markets. It is supply constrained, with demand for housing often leading to older industrial assets being converted to houses or apartments, among other things. And, as if that weren’t enough, there’s limited new construction of industrial assets. All in all, Southern California is a very attractive place to own industrial assets, which is why Rexford Industrial is focused on the region.

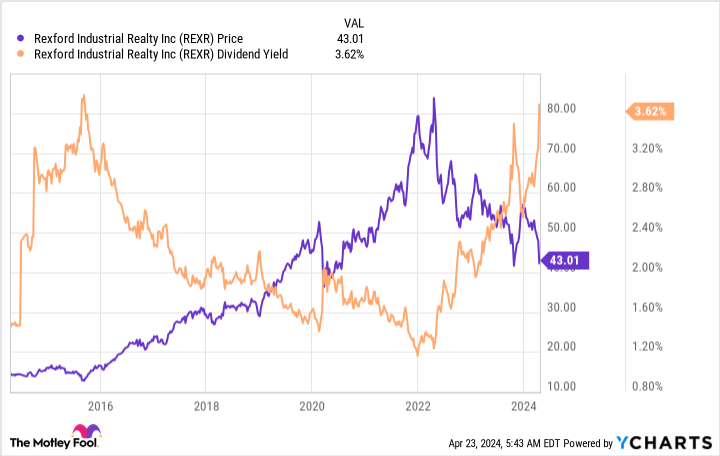

The real estate investment trust (REIT) just announced solid first-quarter 2024 results, with funds from operations up 20.3%. However, investors are worried by the fact that rental increases are starting to slow down from the blistering hot pace experienced over the last couple of years. The company slightly increased its full-year guidance, but shares still cratered, pushing the yield up toward 10-year highs.

REXR Chart

This is a buying opportunity for long-term investors. Notably, Rexford believes that redevelopment and repositioning of existing properties are going to be the main drivers of growth between 2024 and 2026. That’s built into the portfolio already, so there’s no reason to believe the REIT can’t get it done. While the dividend yield is modest at 3.8%, the dividend has been increased at a rapid 15% or so annualized rate over the…

..