Crude oil prices have been on fire this year. WTI, the primary U.S. oil price benchmark, has surged from around $70 a barrel at the start of the year to nearly $90 a barrel recently. Higher oil prices will be a boon for oil companies, which should produce a lot more free cash flow this year.

The rising tide of higher oil prices should lift all boats in the oil patch. However, Chevron (NYSE: CVX), Devon Energy (NYSE: DVN), and Diamondback Energy (NASDAQ: FANG) stand out to a few Fool.com contributors for their ability to cash in on higher oil prices. Here’s why they think that investors should check out these oil stocks.

Chevron isn’t benefiting as much; that’s good for you

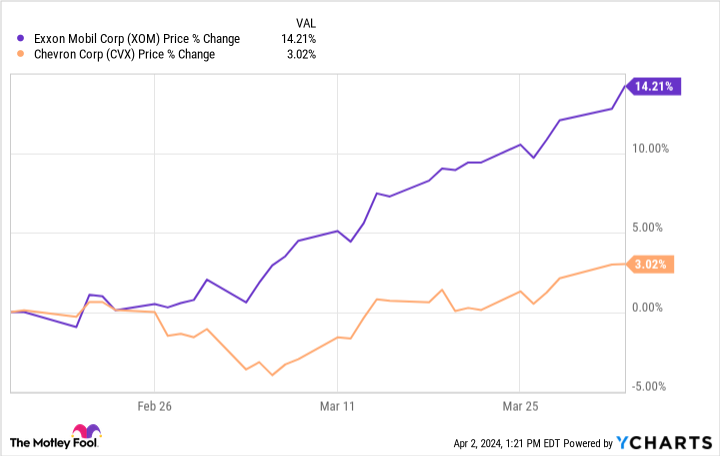

Reuben Gregg Brewer (Chevron): Chevron and ExxonMobil (NYSE: XOM) are similar in many ways. But the stocks of these two integrated energy giants have diverged of late, as Wall Street is worried that Chevron’s acquisition of Hess (NYSE: HES) could fall apart. The problem is that Exxon doesn’t want Chevron to gain a toehold in an Exxon-operated project located in Guyana. To put a number on that divergence, Chevron’s stock is up just a couple of percentage points since mid-February, when rumors of trouble started to circulate, while Exxon’s stock has gained 14%.

XOM Chart

But because of this issue it appears that Exxon’s stock is benefiting more from oil’s recent price moves than Chevron. To be fair, the Hess deal is sizable and the Guyana project is important. But in the long run, this isn’t a make-or-break issue. Chevron is large enough and financially strong enough to do just fine without Hess.

XOM Chart

What’s notable about this divergence is that the stock prices of Chevron and Exxon normally track fairly closely with each other over time. And divergences like this often get resolved with the laggard simply catching up to the leader. A further rise in energy prices could be just what’s needed to get investors excited about Chevron again. And even if that doesn’t happen in the near term, the performance gap is still likely to close over the longer term. You can buy Chevron while it looks…

..