Sometimes it is worth it to buy shares of companies on the dip, and sometimes it isn’t. It all depends on whether there are good reasons to believe the company in question will bounce back, and if it will, there is arguably no better time to invest than when it is down.

Thankfully, even in a bull market like the one we’re experiencing, you can find beaten-down but otherwise exciting stocks to buy. However, other market laggards are better left alone. Let’s consider one stock in each category: Teladoc Health (NYSE: TDOC) and Novavax (NASDAQ: NVAX).

The stock to buy: Teladoc

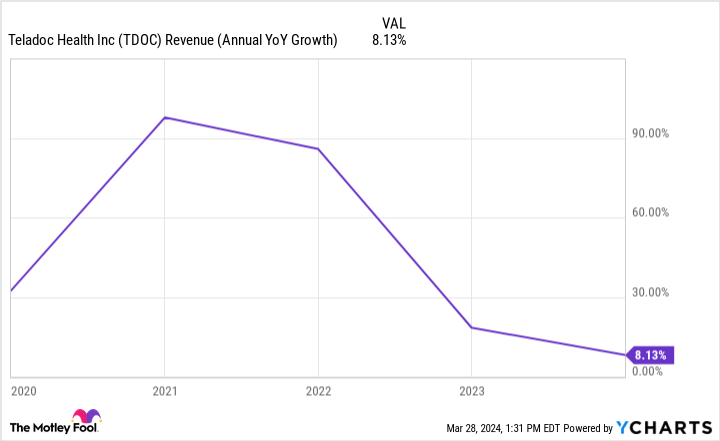

Teladoc is a leader in the telemedicine market, but its position in this industry has not helped it get back in the good graces of investors. The company has recorded sub-par financial results for a while, with slowing top-line growth and persistent net losses. Teladoc rode a pandemic-related tailwind when its business became much more popular amid the outbreak, but things have cooled down. Last year, Teladoc’s revenue increased by just 8% year over year to $2.6 billion.

TDOC Revenue (Annual YoY Growth) Chart

Teladoc did improve substantially on the bottom line. Its net loss per share of $1.34 was much better than the loss per share of $84.60 recorded in 2022. In fairness, Teladoc reported significant non-cash impairment charges in 2022 related to an acquisition. Still, that’s good progress. And despite the company’s struggles, there is hope. Telemedicine wasn’t just some pandemic trend.

It offers convenience to patients and physicians, which is why multiple polls have found that people plan to continue using it. Teladoc boasts a significant ecosystem that includes more than 90 million members and 40,000 clinicians. The company is building a network effect, and as its platform invites more members, it will also invite more physicians (including specialists), and vice-versa. Further, Teladoc’s gross margin is high.

In 2023, the company’s adjusted gross margin was 70.8%, up from 69.1% a year ago. Marketing and advertising expenses remain high for the telemedicine specialist, but these costs should…

..