Whenever I decide on a stock, my mindset is that I’ll stay invested in it for nothing short of a decade. Ideally, you’re investing in great companies you feel comfortable holding on to until retirement. That’s a good way to measure your confidence in the company and the strength of its business model.

The key to investing for retirement is often consistency through the ups and downs and trusting the long-term potential. Here are three stocks I’m adding to my retirement portfolio in March. One is dividend-focused, one is growth-focused, and one is an exchange-traded fund (ETF) that covers a lot of ground.

1. AT&T

AT&T (NYSE: T) is a company whose recent woes have been painful for many of its investors. Surprisingly, the past six months have been a breath of fresh air, with the company showing some positive signs of a potential turnaround.

Despite halving its dividend in early 2022, AT&T still boasts one of the highest dividend yields in the S&P 500. Its current dividend yield is just under 6.5%, making it highly attractive for investors looking for well-above-average dividend income. This yield is over four times higher than the S&P 500’s.

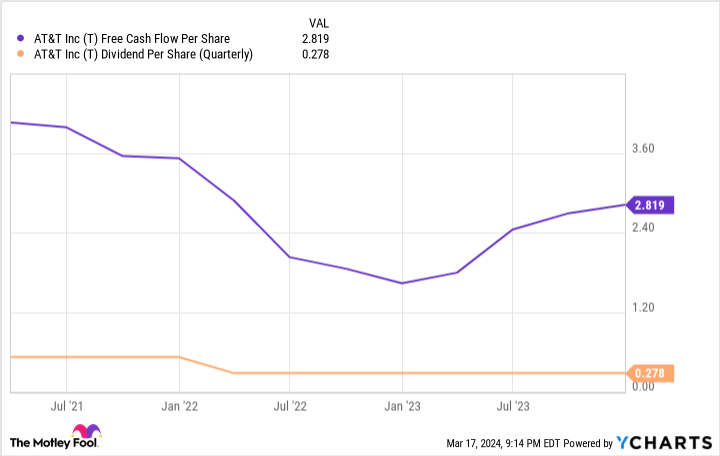

Many have questioned the stability of AT&T’s dividend, particularly because of the company’s high long-term debt. However, I think recent financial performance has eased many of those concerns. AT&T’s debt is undoubtedly worth the criticism, but its free cash flow shows it can cover debt and dividend obligations.

T Free Cash Flow Per Share Chart

The telecom industry has become crucial for daily American life. From personal communication to business operations to other vital services, telecom companies provide a lot of the infrastructure that powers our digital economy and connects our society. That’s why I believe AT&T’s long-term investment appeal is strong.

The company’s recent stock price woes don’t reflect its business importance. And with an ultra-high dividend yield, I feel comfortable waiting for it to work out its kinks while earning steady dividend income for retirement.

Story continues

2. Microsoft

There isn’t a tech company…

..