Many investors are interested in the “Magnificent Seven” stocks for good reasons other than outstanding returns over the last year. This elite group of tech companies has strong brands and a growing customer base, and they are very profitable businesses — everything an investor looks for in a solid investment.

Over the last year, the Roundhill Magnificent Seven ETF has returned 51%, beating the Nasdaq Composite‘s 32% and the S&P 500‘s 23% return. There’s some debate about how long this group will continue to outperform in the near term. On a price-to-earnings (P/E) basis, most of these stocks trade at big premiums to the average stock in the major indexes.

The most expensive of the seven is Nvidia (NASDAQ: NVDA), which currently has a trailing P/E of 77. Despite its high valuation, the company’s superior growth and future opportunity could justify more new highs for years to come. Here’s why the stock remains a core holding in my portfolio.

Nvidia’s growth runway

Nvidia is benefiting as data centers switch from central processing units (CPUs) to the far more powerful graphics processing units (GPUs) for artificial intelligence (AI) workloads. Historically, data centers spent about $250 billion per year on infrastructure, but this amount has increased for the first time in many years, which could be just the beginning of a major spending boom.

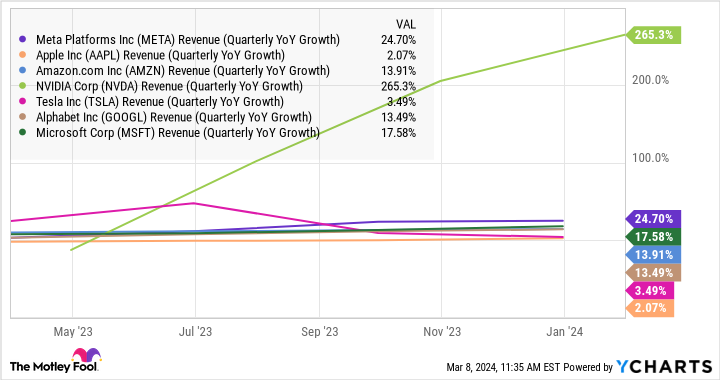

The market for Nvidia’s products is proving to be much bigger than originally thought a few years ago. Revenue surged 265% year over year to $22 billion in the fiscal fourth quarter, significantly outpacing the growth for the other Magnificent Seven companies.

META Revenue (Quarterly YoY Growth) Chart

Nvidia is just scratching the surface of this opportunity. Company executives have talked about $1 trillion worth of data center infrastructure that is starting to adopt accelerated computing, which is the use of multiple GPUs running together to handle large data workloads.

However, the opportunity could be much bigger. AI is allowing companies to use data in ways that was not possible before, as Nvidia chief financial officer…

..