With the S&P 500 index up more than 25% over the past year and 6.5% so far in 2024, it’s time to look beyond the usual suspects and toward stocks that haven’t participated in the rally so far this year. Whirlpool (NYSE: WHR) and Owens Corning (NYSE: OC) match this description and I think they have the potential to do well through the year. Here’s why.

Why Whirlpool stock is a buy

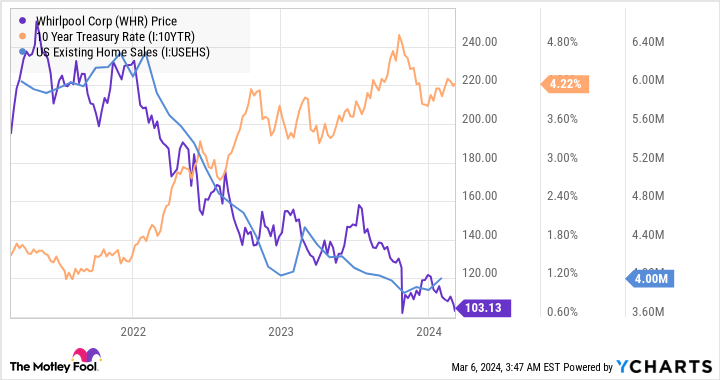

As you can see below, the housing market (expressed here in terms of sales of existing homes) doesn’t like higher interest rates, and Whirlpool’s share price doesn’t like a declining housing market.

WHR Chart

As such, the uptick in interest rates (which push up mortgage rates) in 2024 on the back of hotter-than-anticipated inflation data is not good news for Whirlpool or, rather, sentiment over its stock.

During a recent presentation to investors, management outlined that a quarter of demand for appliances in the U.S. comes from discretionary demand guided by existing home sales, and a further 15% is from the construction of new homes. In other words, 40% of end demand is guided by housing market conditions.

Chart by author. Data source: Whirlpool presentations.

As such, sentiment over the stock is going to be guided by interest rate movements. However, long-term investors should focus on the underlying improvement in the business coming from refocusing on its core North American market. Whirlpool is about to combine its European business with a subsidiary of a Turkish company, Arcelik, while taking a 25% stake in the new company — a deal that will pull it out of Europe directly. Whirlpool also cut costs by $800 million in 2023, with a further $300 million to $400 million expected in 2024.

Moreover, history suggests that the interest rate cycle will turn, and so will the demand for housing. That will help management achieve its aim of growing earnings before interest and taxation (EBIT) margin to 9% in 2026 from 6.8% in 2024. In addition, management thinks it can hit free cash flow (FCF) of $1.1 billion in 2026, representing 19.5% of the current market cap. If it gets anywhere near that…

..