Investors often look to metrics like P/E to assess valuation, which is perfectly fine. But dividend yield can also be used in this way. In fact, given the variability of earnings and the relative consistency of dividend payments, you could argue that yield is a better measure of investor sentiment. That’s why high-yield Enterprise Products Partners (NYSE: EPD) and TotalEnergies (NYSE: TTE) look like cheap energy stocks you might want to buy today.

Enterprise’s yield is historically high

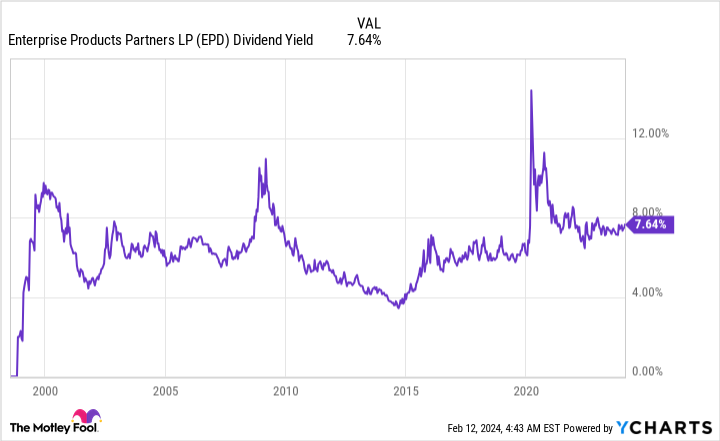

Enterprise’s 7.6% distribution yield is at the high end of its historical yield range. That suggests the master limited partnership (MLP) is relatively cheap today. Of course this alone doesn’t make it worth buying.

EPD Dividend Yield Chart

The good news is that backing the high yield is a distribution that has been increased for 25 consecutive years. The MLP’s balance sheet is also investment grade-rated. And distributable cash flow covered the distribution 1.7 times over in 2023. In other words, the high yield appears well supported.

Enterprise’s business, meanwhile, is built for consistency. It owns the energy infrastructure that’s used to transport oil, natural gas, and the products into which they get turned around the world. Customers pay fees for the use of the assets, so volatile commodity prices aren’t nearly as important as demand for energy. Energy demand tends to be resilient even when oil prices are low. The negative here is that the yield will probably make up the lion’s share of the return investors see because business growth is likely to be modest. However, if you’re looking to maximize the income your portfolio generates, Enterprise should definitely be on your short list right now.

TotalEnergies’ yield is relatively high

Integrated energy giant TotalEnergies’ closest peers are ExxonMobil (NYSE: XOM), Chevron (NYSE: CVX), BP (NYSE: BP), and Shell (NYSE: SHEL). Of this group, it has the highest dividend yield at roughly 5%. That hints that investors are discounting the stock relative to its peers.

Story continues

TTE Dividend Yield Chart

What’s interesting here is that…

..