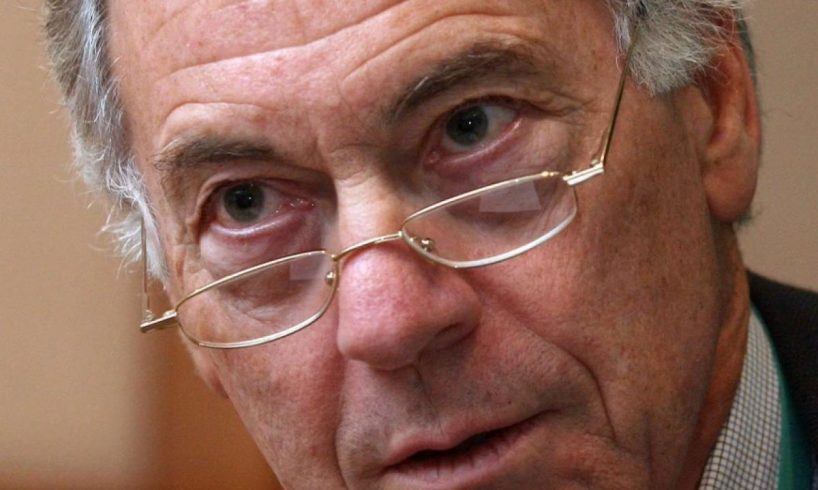

Steve Hanke.Steve Hanke

Steve Hanke expects stocks to falter, a recession to hit, and inflation to fall below 2% this year.

Stocks are trading at lofty valuations that will decrease as a downturn sets in, the economist says.

The shrinking US money supply will choke economic growth and curb the pace of price rises, he says.

Expect the stock market to retreat, a recession to strike, and inflation to drop below 2% by the end of this year, Steve Hanke says.

“As far as the outlook for stocks goes, they remain pricey, and the multiples will come off as the recession starts to bite,” the professor of applied economics at Johns Hopkins University told Business Insider this week.

The benchmark S&P 500 index rallied by 24% in 2023 and now trades close to a record high. Stocks are typically valued at multiples to company earnings, so they tend to fall when multiples contract or earnings shrink — both of which can happen in an economic downturn when investor sentiment and corporate profits usually suffer.

Hanke, a former economic advisor to Ronald Reagan, served as the president of Toronto Trust Argentina when it was the world’s best-performing market mutual fund in 1995. His view is that the volatile inflation of recent years is chiefly due to changes in the US money supply, not other factors such as supply-chain disruptions and swings in energy and metal prices.

The veteran economist and a colleague, John Greenwood, predicted in July 2021 that the headline Consumer Price Index would rise as quickly as 9% on an annualized basis; it peaked at 9.1% a year later. They later forecast the inflation measure would fall to between 2% and 5% by December last year, and it ended the year at 3.4%.

“As Milton Friedman taught us long ago, inflation is always and everywhere a monetary phenomenon,” Hanke said. “That’s why our forecast, based off the quantity theory of money, has been so accurate.”

Now, Hanke and Greenwood predict headline inflation will fall below the Federal Reserve’s target rate of 2% by the end of this year. They proposed in the National Review this week that 6% annual…

..