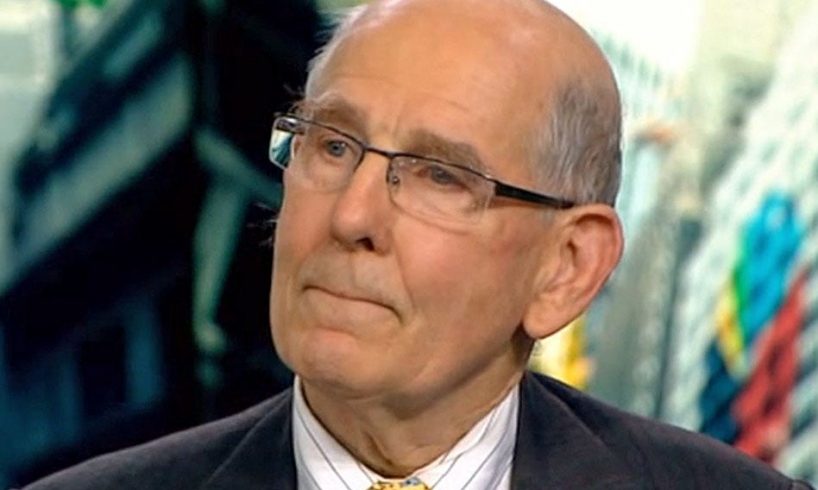

Gary Shilling.Bloomberg

Gary Shilling expects a 30% crash in stocks, a recession, and a commercial real estate collapse.

The veteran forecaster has been issuing dire predictions about markets and the economy for years.

Here are his 14 best posts on X since the pandemic struck in early 2020.

Gary Shilling recently warned the S&P 500 could plunge 30%, a recession is imminent, and commercial real estate is a bubble about to burst. He’s been issuing similarly dire predictions for years.

The veteran forecaster, who served as Merrill Lynch’s first chief economist before launching his own firm in 1978, has made several striking calls on X.

For example, he correctly predicted in early March 2020 that the stock market would keep plummeting. But he mistakenly dismissed the inflation threat a year later, and his cautions regarding stocks and the economy have missed the mark for more than a year now.

Here are Shilling’s 14 best X posts since the pandemic, lightly edited for length and clarity:

1. “10-yr Treasury note yield is below 1%, equities are in free-fall. If this doesn’t foretell global recession and further big equity price declines, I don’t know what would, especially in view of the Fed’s unexpected and large rate cut today.” (March 3, 2020)

Shilling’s call was correct as the S&P 500 crashed by another 25% before bottoming below 2,300 points on March 23, and global GDP shrank by 3.4% in 2020.

2. “Fear of the spreading #coronavirus is driving #StockMarket panic. With consumer and business retrenchment and worldwide supply chain disruptions, the global #recession2020 I’ve been anticipating is almost certain.” (March 6, 2020)

3. “#WallSt rallies on hopes the worst of the #CoronavirusOutbreak is over. To me, it’s like 1929 when stocks first fell, then rallied before plunging anew as the Great Depression set in. Today, the damage to worldwide economies is yet to unfold and stocks will collapse to new lows.” (April 7, 2020)

Story continues

Shilling’s prediction was off the mark as the S&P 500 steadily climbed to a peak of about 4,800 points in November 2021, fell to below 3,600…

..