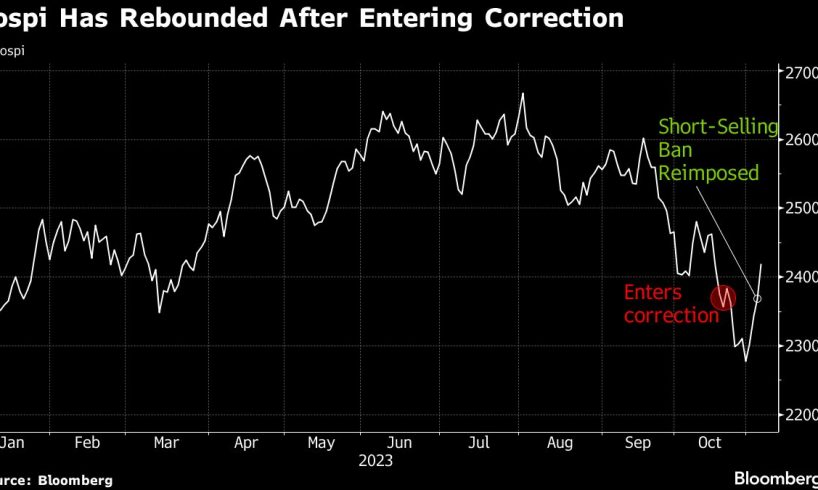

(Bloomberg) — South Korean stocks surged after regulators reimposed a full ban on short-selling for about eight months, a controversial move that authorities said was needed to stop illegal use of a trading tactic deployed regularly by hedge funds and other investors around the world.

Most Read from Bloomberg

The ban may help appeal to retail investors who have complained about the impact of shorting — the selling of borrowed shares by institutional investors — ahead of elections in April. However, it could deter some foreign investors and hold back MSCI Inc. from upgrading Korean equities to developed market from emerging status.

The benchmark Kospi jumped as much as 4%, the most since January 2021, leading gains among major regional gauges in Asia on Monday. Stocks that had seen recent jumps in short-selling positions, including LG Energy Solution Ltd. and Posco Future M Co., were among the biggest boosts. The small-cap Kosdaq Index surged as much as 5.9%, the most since June 2020.

The nation’s Financial Services Commission said on Sunday that new short-selling positions will be prohibited for equities on the Kospi 200 Index and Kosdaq 150 Index from Monday through the end of June 2024. Pandemic-era restrictions on the practice had been lifted for those two gauges only in May 2021, while the ban has remained in place for some 2,000 stocks.

READ: South Korea to Ban Short-Selling of Stocks Until June 2024

The move comes ahead of general elections in April for the National Assembly in South Korea, where public perception of short-selling remains deeply negative. Some ruling party lawmakers urged the government to temporarily end stock short-selling in response to demands by retail investors, who have staged protests against the tactic. Most short-selling in South Korea is conducted by institutional investors.

Story continues

“This policy reversal with respect to short selling is unwarranted at the current time,” said Wongmo Kang, an analyst at Exome Asset Management. “Many people view it as a political move aimed at next year’s general election,” he…

..