This year’s strong rally has stuttered over the past few weeks. August has generally seen increased volatility and declines in the main market indexes. But that hasn’t affected a basic truth of the financial markets: stocks are individuals, and they rise and fall for idiosyncratic reasons. Investors should always check under the hood, to find out if a bargain price represents a good buy.

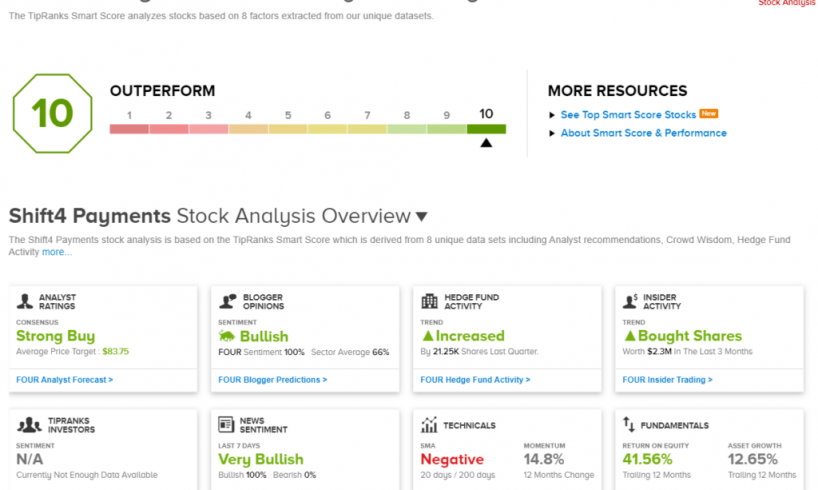

That check can be rough, however, as there are reams of data to sort. Fortunately, investors can always turn to the Smart Score, an AI-powered data collection and collation tool, based on the TipRanks database, that rates every stock according to a set of factors proven by history to match up with future outperformance. Look for stocks that combine the highest Smart Score, a ‘Perfect 10,’ with a pullback in share price – that’s where the true bargains may be hiding.

We can get started with a look at two Strong Buy stocks that feature both reduced share prices and a ‘Perfect 10’ from the Smart Score. These are stocks that have attracted analyst attention; are they right for you?

Shift4 Payments (FOUR)

The first ‘Perfect 10’ stock on our list is Shift4 Payments, a tech firm working in the payment processing business. The Allentown, Pennsylvania-based firm provides services across a wide range of industries, and counts some big names among its customer base: Best Western Hotels, Applebee’s, the Utah Jazz, Gold’s Gym. Overall, the company boasts more than 200,000 customers and over 7,000 sales partners, and processes more than 3.5 billion transactions worth more than $200 billion annually.

In an important announcement, earlier this month Shift4 indicated that it is nearing the closure of its Finaro acquisition. The $525 million move will give Shift4 access to Finaro’s European processing network. The deal was expected to have closed in March of this year, but was held up due to ‘regulatory requirements;’ it is now expected to close in Q3/early Q4.

Story continues

The company reported its 2Q23 results early this month, and showed a series of gains, including…

..