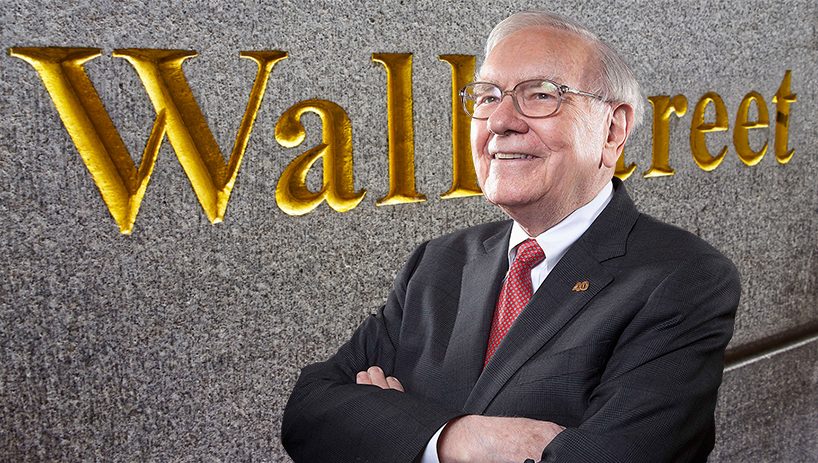

Sometimes identifying the best stocks to buy can be difficult, but you could do a lot worse than checking out the stocks selected by one of the world’s savviest hedge fund managers – Warren Buffett.

Buffett’s stock picks are a popular source of inspiration for investors, and for good reason. His formidable stock-picking ability has given him the nickname ‘the Oracle of Omaha’ and a fortune of ~$117 billion, making him one of the richest people in the world. His firm, Berkshire Hathaway, is also counted among the most successful, boasting total assets of over $1 trillion.

So obviously when Buffett goes shopping, investors are keen to find out what’s in the bag. During Q2, Buffett opened new positions in a few homebuilding stocks, and as he is known for his value investing style, he must think these names offer just that right now.

But it’s not just Buffett who likes the look of these particular equities. Raymond James analyst Buck Horne has also pinpointed an opportunity in these stocks, believing they are primed to deliver double-digit growth over the next year.

For a fuller view of their prospects, we decided to run these tickers through the TipRanks database. Here’s what we found.

D.R. Horton, Inc. (DHI)

The first stock Buffett is betting on is D.R. Horton, a Texas-based construction firm and a leader in the US homebuilding industry. The company has held the title of the ‘nation’s largest homebuilder’ for more than 20 years and operates in 113 residential markets across 33 states. D.R. Horton works on projects for both single-family homes and multi-family apartment complexes.

D.R. Horton has been building homes for 45 years, and has closed over 1 million building contracts in that time. The company has a portfolio of designs, featuring homes in all price brackets, from under $200,000 to over $1 million, and can even implement smart home technology from ground up during construction.

While the company holds a leading position in its industry, it has felt the effects of real estate headwinds. Earnings are down year-over-year for the past several…

..