The U.S. electric grid is undergoing a huge transformation and renewables have steadily become more widely adopted over the past decade.

Adoption is set to continue at a brisk pace, says Goldman Sachs analyst Carly Davenport. Looking ahead, Davenport reckons that by 2032, over 45% of the U.S.’s power generation capacity will come from renewable sources and 6% from coal. That compares to a mix of 30%/16% today and 17%/27% in 2012, making the ongoing change very clear.

With this as backdrop, boosted by the Inflation Reduction Act, and as the power generation mix shifts and the Energy transition advances, Davenport believes utilities are “uniquely positioned to facilitate this shift and address associated challenges in a way that creates a cleaner power grid while maintaining reliability and customer affordability.”

“This shift will require a significant amount of capital investment,” the analyst went on to add, “which we believe will contribute to attractive earnings and rate base growth in the coming years.”

And investors can obviously take advantage of this development, too. With themes such as clean technology, nuclear power, LNG (liquefied natural gas) project additions, and “transmission build out” coming to the fore, investors stand to make use of an “attractive investment opportunity set.”

Davenport has compiled a list of stocks, what she and her team call “Decarbonization Enablers,” that are well positioned to take advantage of this trend – and she sees three names posting double-digit growth over the coming months. We ran these picks through the TipRanks database to get a fuller view of their prospects. Let’s check the results.

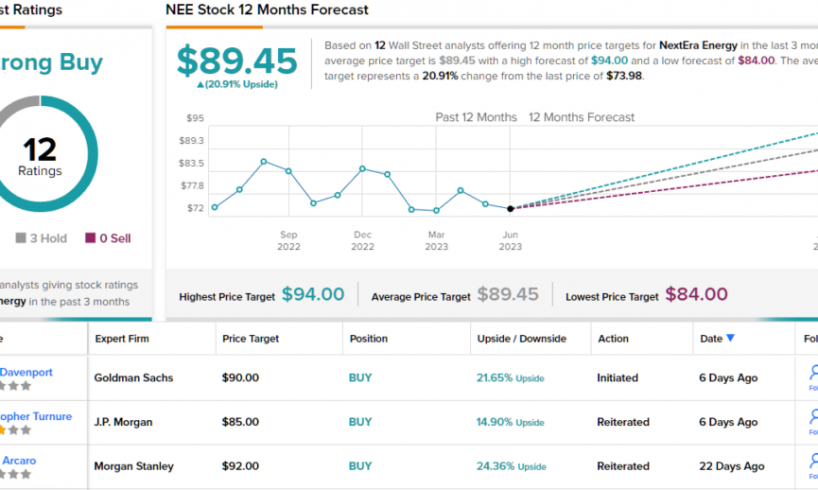

NextEra Energy, Inc. (NEE)

We’ll start with NextEra Energy, a Florida-based electric utility firm, which, with its $150 billion market cap, is one of the largest utility holding firms in the US utility landscape. NextEra’s chief subsidiary is Florida Power & Light (FPL), which boasts more than 5.8 million customer accounts and provides power to more than 12 million people across Florida. The company…

..