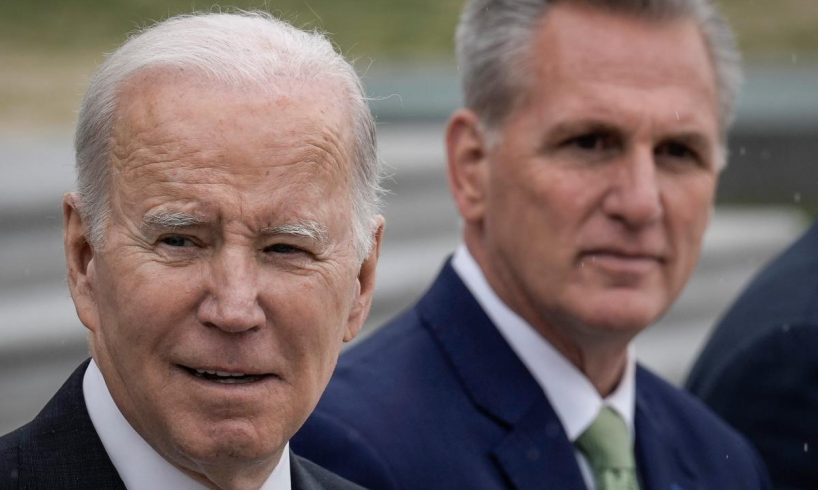

U.S. President Joe Biden and Speaker of the House Kevin McCarthy (R-CA) depart the U.S. Capitol following the Friends of Ireland Luncheon on Saint Patrick’s Day March 17, 2023 in Washington, DC.Drew Angerer/Getty Images

The US debt ceiling showdown in Congress is fast approaching a potential early June deadline.

Republicans and Democrats appear to be at an impasse with no progress made towards a deal.

These are the four scenarios and their potential impact on the US economy, according to Ned David Research.

The latest debt ceiling showdown appears to be extraordinary as no party is in full control of Congress, and that could lead to disastrous outcome for the US economy, according to a Wednesday note from Ned Davis Research.

While the ongoing US debt ceiling showdown in Congress is nothing new for investors, as the debt limit has been raised year after year with a typical show of political theater, it could have grave implications if the crisis isn’t ultimately solved this time around.

“Market participants have been conditioned over the years to expect that any debt ceiling impasse would be resolved in time to avoid a default, even if it comes down to the wire. It runs on the trust that politicians understand that the potential consequences of a default are too dire, including wreaking havoc on the global financial system and causing a recession in the US and possibly the global economy,” NDR explained.

The note referenced what happened in 2011 as a barometer for what’s possible this time around, in which the S&P 500 sank nearly 20% over a period of a few months because the US lost its AAA rating from Standard and Poor’s due to the political brinkmanship that was sparked by a debt ceiling crisis.

“While we expect that the debt limit will be adjusted again, we see a significant risk of financial market volatility between now and the X-date of June 1,” NDR said.

These are the four potential outcomes of the current US debt ceiling showdown in Congress, according to the note.

1. Standoff continues past the X-date – 5% odds.

In this most dire scenario, the US government would…

..