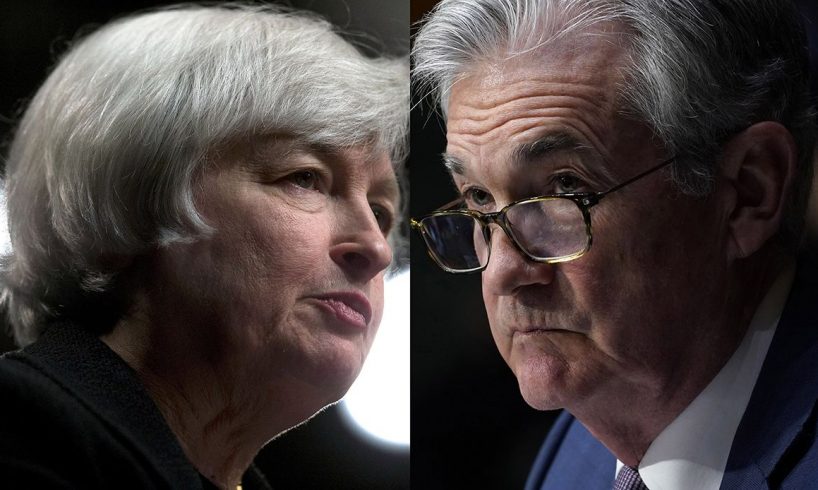

(Bloomberg) — Traders are accustomed to a bumpy ride whenever Jerome Powell speaks. But when Powell speaks at the same time Janet Yellen is talking to Congress about the health of the banking sector, the turbulence can get overwhelming.

Most Read from Bloomberg

That’s what happened Wednesday afternoon as the back half of the Federal Reserve chairman’s press conference overlapped with the Treasury Secretary’s appearance before a Senate subcommittee. The S&P 500 fell, rose, went back to unchanged then plunged again as traders tried to synthesize comments on the health of the economy, rates trajectory, the state of banks and how far the government will go to protect depositors.

It’s rare that two people of such stature speak at the same time, worse when they project messages that traders interpreted as in opposition. A little while after hearing what they thought was Powell tipping broader protection to depositors should financial stress spread, Yellen came on the feed to knock the hope down. The S&P 500 erased an earlier gain of 0.9%, marking the sixth time this year that an intraday rally of that size was reversed.

“It’s astounding that Yellen and Powell would have given contradictory messages on bank deposits at the same time,” said Steve Chiavarone, senior portfolio manager and head of multi-asset solutions at Federated Hermes. “Powell essentially said that all deposits are safe, Yellen said, ‘Hold my beer.’ You would have thought that they would have coordinated.”

Asked about a broad increase in deposit insurance, Yellen said that it was “not something that we have looked at. It is not something we are considering.” That happened right around 3 p.m. in New York, after Powell said that the banking system was sound. Yet some argued that his insistence that the Fed would continue to raise rates higher than expected if it sees the need to do so also helped push stocks lower.

Story continues

Traders noted that bank stocks took the brunt of the pain following Yellen’s comments. The SPDR S&P Bank ETF (ticker KRE), which tracks regional banks…

..