Text size

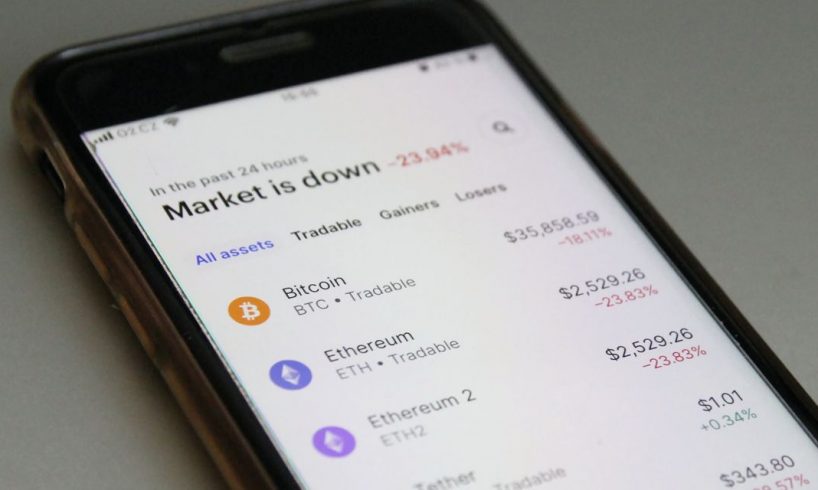

Crashing crypto prices have pushed away many of Coinbase’s core customers—retail traders.

David Myslivec/Dreamstime.com

Wall Street is mostly muted ahead of earnings from

Coinbase Global

,

expecting to see deep losses and the lowest quarterly sales in two years from the cryptocurrency broker when the group reports earnings after the bell on Tuesday.

A generally downbeat tone from analysts—amid growing regulatory headwinds and few signs of a recovery in the key trading business—puts a remarkable recent rally from Coinbase (ticker: COIN) stock in the spotlight. But even though the shares are up more than 80% so far this year, at least one analyst sees room for more gains.

The eye-popping rally to start 2023 belies what a bad stretch Coinbase has had, with the stock down by around two thirds from a year ago.

Coinbase stock was not only dragged down by a hard year for the whole market in 2022—amid skyrocketing interest rates, which dampen demand for high-growth plays like those in tech and crypto—but its losses were exacerbated by a crypto crash. Plunging prices for

Bitcoin

and other tokens, crucially, pushed away many of the retail investors who are core to Coinbase’s trading business and have yet to return in force.

Add to that increasing regulatory headwinds, and the picture hasn’t been so rosy of late. Regulators have ramped up scrutiny on digital assets since the collapse of rival exchange FTX in November, with federal agencies accelerating a crackdown on crypto companies, products, and services in recent weeks.

All that—against the backdrop of a rally in the…

..