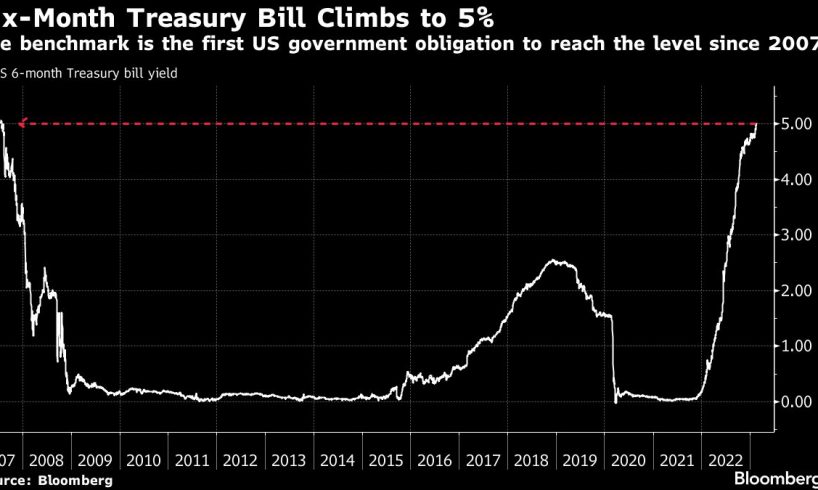

(Bloomberg) — For the first time in nearly two decades, investors can earn more than 5% on some of the safest debt securities in the world. That’s competitive with riskier assets like the S&P 500 Index.

Most Read from Bloomberg

There’s just a small catch: US Treasury bills have become less safe, because without an act of Congress, the payment may be delayed.

Six-month Treasury bills this week became the first US government obligations since 2007 to yield more 5% as traders ramped up expectations for additional Federal Reserve interest-rate hikes. One-year bill yields approached the threshold. Meanwhile the clock is ticking to raise the federal debt limit, with the Congressional Budget Office warning that the government will otherwise run out of cash as soon as July.

Nevertheless, with returns on six-month bills now a whisker away from the earnings yield on the benchmark equity index, it’s a risk investors appear willing to take, as weekly bill auctions continue to draw strong demand.

“Cash has become king,” said Ben Emons, senior portfolio manager at NewEdge Wealth. “At such higher rates these cash-like instruments become a much better risk-management tool in your portfolio than other things. If you put 50% of your portfolio now in bills and the rest in equities then your portfolio is better balanced.”

Previous debt-limit fights have created opportunity for investors in bills by cheapening them, and this one is no exception, Emons said. He predicts a protracted political battle over raising the debt limit to produce an agreement in time to avert a default.

Six-month bills sit squarely in the window in which the CBO and Wall Street strategists project the government will run out of cash if Congress doesn’t raise the debt ceiling. If some investors are avoiding them for that reason, others are getting paid to take the risk. The yield has surged 16 basis points over the last two auctions, the steepest back-to-back increase since October.

Story continues

On the auction front next week, the Treasury plans to sell $60 billion of three-month bills, $48…

..