Corporate insiders give us one of the clearer signals available in the stock markets. The insiders are company officers, with ‘inside’ positions that give them greater access to company plans and resources, the very facts that will impact stock prices.

Governmental regulators require insiders to publish their trades in a timely manner, as a way of avoiding their having an undue advantage, and retail investors can use tools like the Insiders’ Hot Stocks to follow these trades.

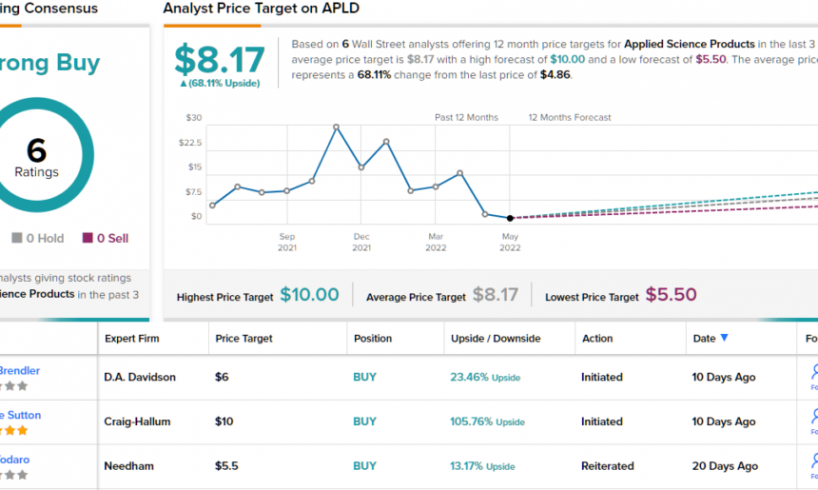

We’ve gotten the process started, using the tool to pull up the latest data on three stocks that insiders have been scooping up. The buys are notable for their magnitude – these insiders are laying out six figures or more on their own firms’ shares, and that’s not a move taken lightly. All three are also considered Moderate or Strong Buys by the consensus of the Wall Street analysts, and are projected to pick up steam in the months ahead.

Applied Blockchain (APLD)

Applied Blockchain, as its name suggests, is heavily involved in the bitcoin mining segment; in fact, the company builds and operates the next-gen data centers that power the North American bitcoin mining industry.

In the first half of this year, Applied Blockchain has made some important moves to increase its footprint in the industry. In January, the company announced a partnership with Antpool Capital Asset, a provider of blockchain mining solutions, that will allow the two signatories to pool resources in the development of 1.5 gigawatts worth of new datacenter hosting capacity by the end of 2023. And in May of this year, Applied Blockchain held the formal opening ceremonies of its 100 megawatt facility in Jamestown, North Dakota. The facility is currently operating at 83 megawatts capacity, and is scheduled to fill out the remainder of its capabilities by the end of this calendar year.

Blockchain data centers, bitcoin mining, and their power requirements don’t come cheap, and Applied Blockchain raised capital in April of this year through its IPO. The company originally filed for a $60 million public offering; in…

..