(Bloomberg) — Get ready for a fresh slump in the world’s most-watched stock index, as economic growth fears spiral and the Federal Reserve embarks on its biggest policy-tightening campaign in decades.

Most Read from Bloomberg

With the S&P 500 flirting with a bear market last week and notching more than $1 trillion in losses, participants in the latest MLIV Pulse survey reckon there’s more pain to come.

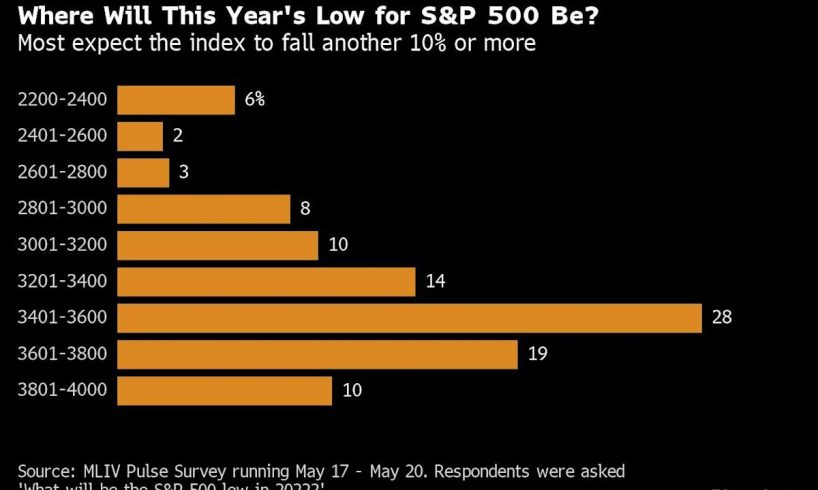

The gauge is likely to keep falling this year before bottoming at around 3,500, according to the median projection of 1,009 respondents. That represents a decline of at least 10% from the Friday close of 3,901 — and a gut-wrenching 27% drop from the January peak. S&P 500 futures traded 0.9% higher as of 7:45 a.m. Eastern time.

The Fed’s hawkish-at-all-costs posture, the chaos in supply chains and intensifying threats to the business cycle are all undermining confidence in Corporate America’s profit machine, while equity valuations keep sinking.

After the longest run of weekly losses in more than two decades, just 4% of the MLIV readers reckon the S&P 500 has found a bottom for the year based on closing levels. And a handful see a historic rout in motion to 2,240 — re-testing the pandemic lows.

Money managers endured a worse drawdown in the Covid-spurred tumult of 2020, but that’s scant consolation with projected losses of this scale.

“I still think the worst is not behind us,” said Savita Subramanian, head of US equity and quantitative strategy at Bank of America Corp., on Bloomberg Television Friday. “There’s a pervasive fog of negative sentiment out there.”

Sobering profit assessments from the likes of retailer Target Corp. and network-equipment company Cisco Systems Inc. saw investors take the ax to share prices last week. Short interest in a popular exchange-traded equity fund jumped near levels last seen in March 2020.

Story continues

The renewed haven bid for US government bonds suggests money managers are getting increasingly fearful about the economic trajectory, with lockdowns in China and the prolonged Russia-Ukraine conflict taking their…

..